The National Retail Federation report says that 2022 holiday sales grew to a record $936.3 billion. This is an increase of 5.3% since the year prior.

Good news for the retailers!

As long as you prepare beforehand, you can cash in on the Black Friday and Cyber Monday traditions this year.

A few looming questions for this Black Friday and Cyber Monday season are:

- How many customers will shop during this Black Friday?

- What the trending products will be?

- What are the top considerations when shopping for deals?

- What are buyers’ attitudes toward the Black Friday tradition?

- When should the sales start this year?

- How many customers want to book an appointment for shopping?

First things first—

When’s Black Friday this year?

November 24th.

And how to properly prepare for it?

We did our own research and asked over a thousand shoppers about their intentions, expectations, and insights about the event to help you make the most out of it.

We’ll compare some of this year’s results with the ones from last year’s study and add Black Friday numbers from third-party stats.

So—

Let’s start by looking at the major discoveries of our recent survey.

Black Friday statistics: main findings

It seems that people can’t wait for the sales this year. So, if you’re a business owner, then you probably want to prepare for Black Friday and Cyber Monday in the best way possible.

Check the findings of our recent study to know what to expect during the 2023 Thanksgiving weekend sales:

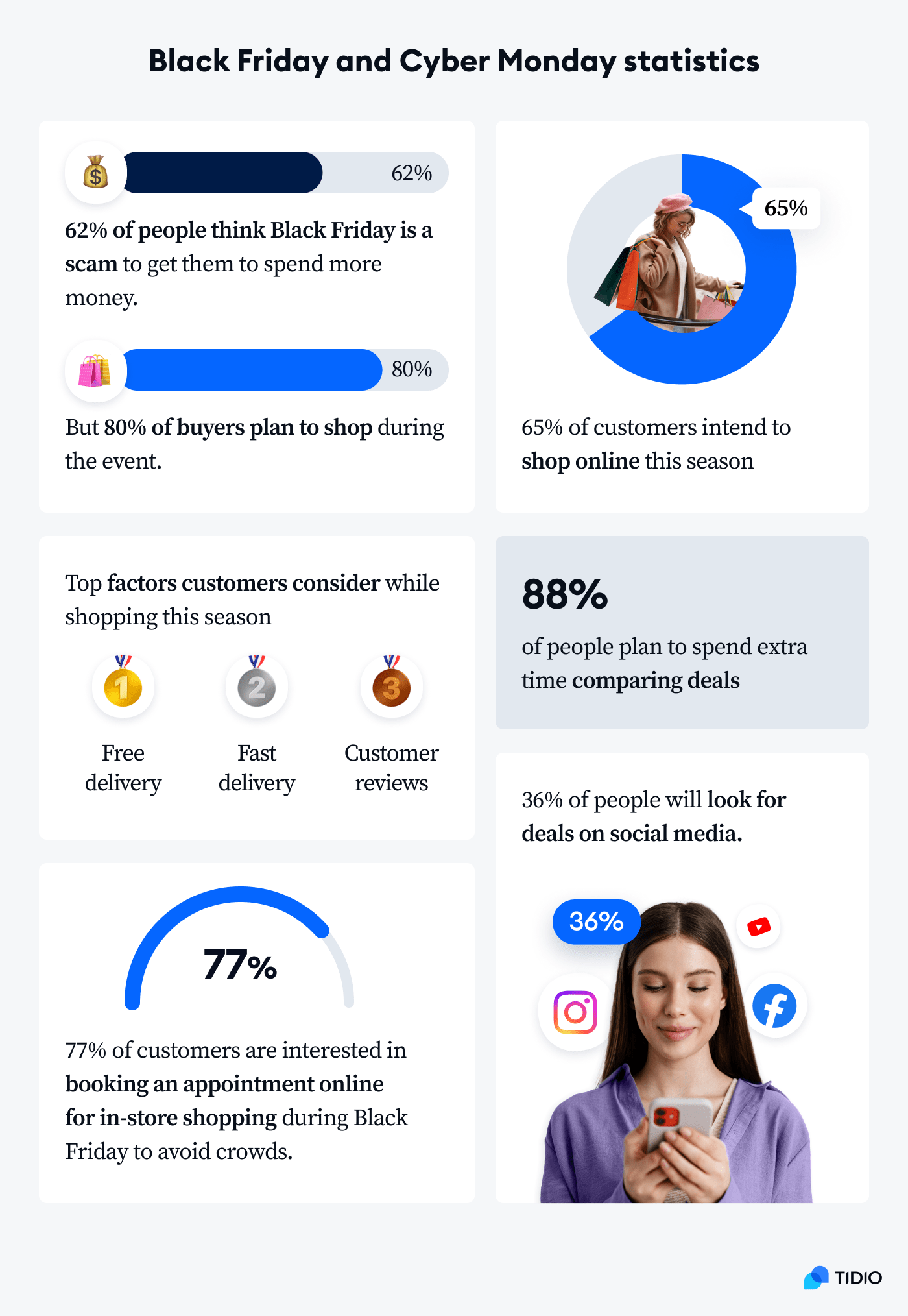

- Over 62% of buyers think Black Friday is just a scam to get people to spend more money than they normally would. However, this doesn’t stop them from shopping, as over 80% of people state that they intend to shop on Black Friday and Cyber Monday.

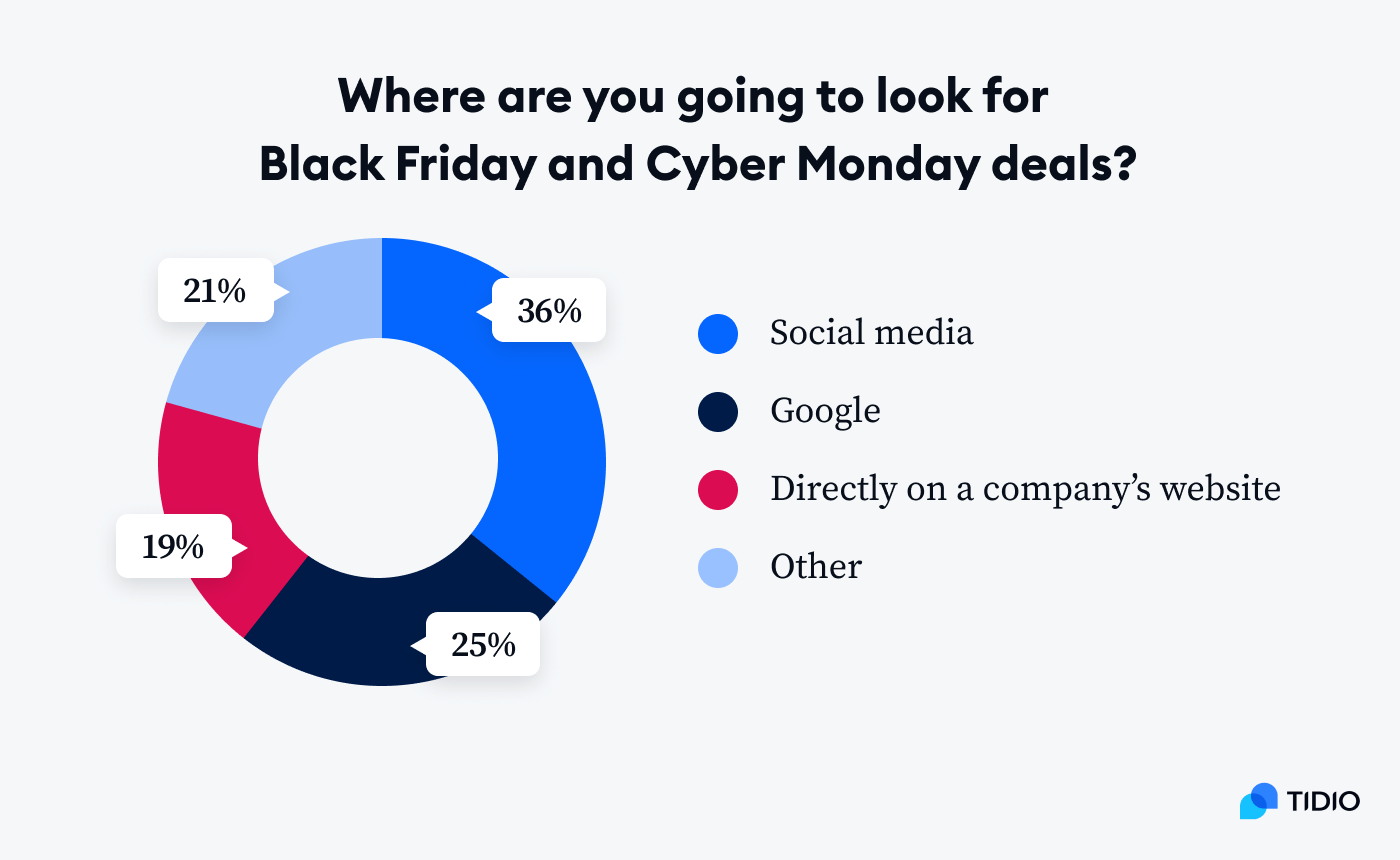

- As many as 65% of customers intend to shop online this season, and 36% of them will look for deals on social media. Therefore, retailers must intensify their efforts to build their ecommerce presence and invest in social media ads.

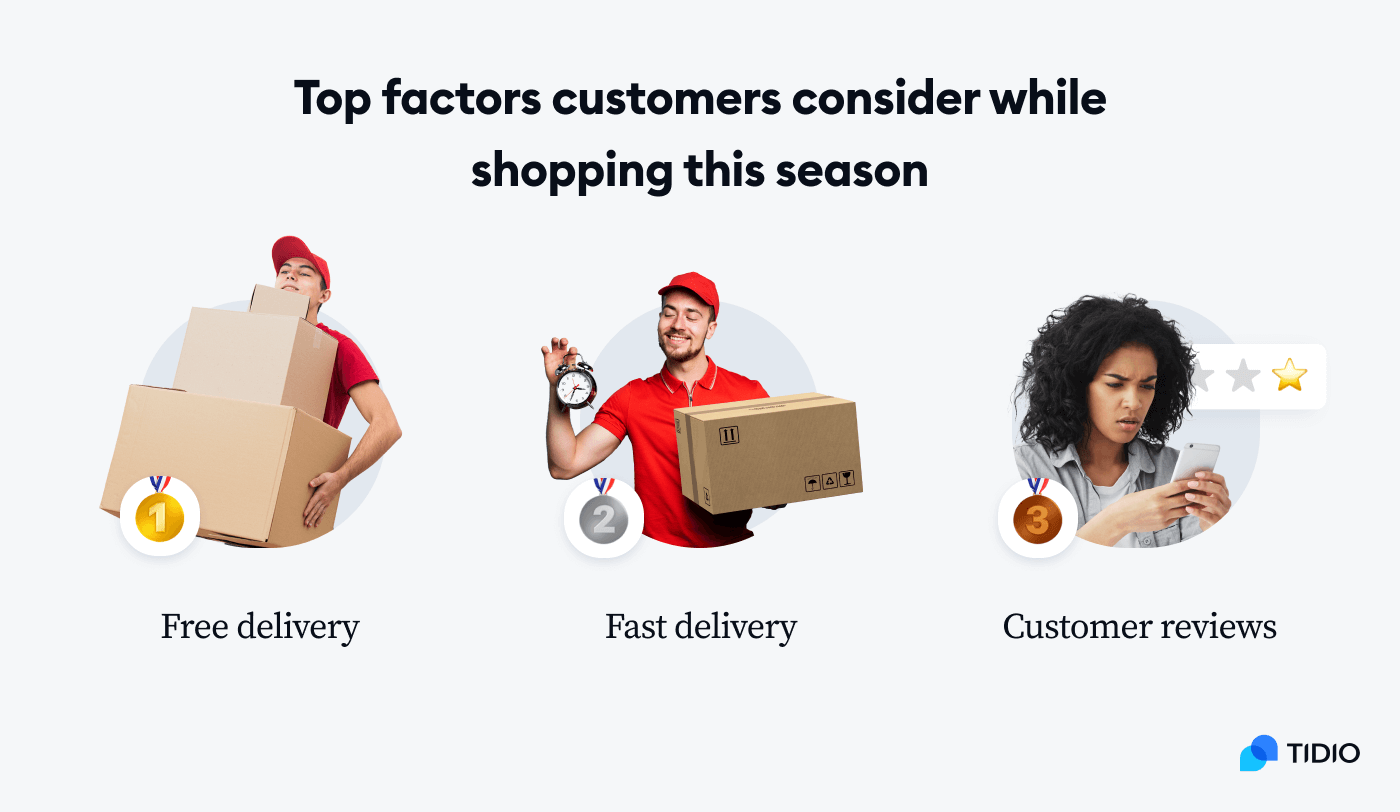

- Savings are not in the top three considerations for people shopping on Black Friday. Fast, free delivery, and store pick-up are the three most important things for shoppers. So, your business should prepare delivery systems for the increased demand. For example, you can hire enough staff to dispatch orders or stock up on your bestsellers.

- Customers do more research before deciding on Black Friday and Cyber Monday deals than before. As many as 88% of respondents say that they are willing to spend extra time comparing deals, and some of them will even spend a couple of hours on that.

- A whopping 77% of customers are interested in booking an appointment online instead of in-store shopping to avoid crowds.

This is the day that shops supposedly make most of their profit:

Now, let’s take a look at how many shoppers spend during this season.

How much do people spend on Black Friday and Cyber Monday

A report on Black Friday shopping statistics states that the total revenue from the last holiday season amounted to nearly $1.27 trillion. This includes the Black Friday sales numbers of $283 billion spent in online stores and ecommerce sales amounted to about $281 billion during the Cyber Monday sales Week.

What’s the average amount spent on Black Friday?

According to research, shoppers spend $325 on average during the Thanksgiving period. On top of that, another study shows that approximately 4 in 10 holiday buyers are willing to go into debt on their credit cards because of holiday shopping.

Each year the sales numbers are huge.

But, even subtle changes in the shoppers’ behavior can have a massive impact on consumer spending patterns. Detecting these variations can help businesses satisfy their customers by better understanding their expectations for 2023.

Learn how to use the power of AI to maximize BF marketing efforts

Over 80% of people take part in shopping during the Black Friday and Cyber Monday events

In numbers, how many people shop on Black Friday?

A study shows that in the US alone, over 140 million planned to shop on Black Friday in 2022.

On top of that, our Black Friday stats present that nearly 39% of shoppers save money for the event. Some of the customers will do Christmas shopping, some will buy products they’ve been wanting for a while, and others just want to purchase new items they like on the day.

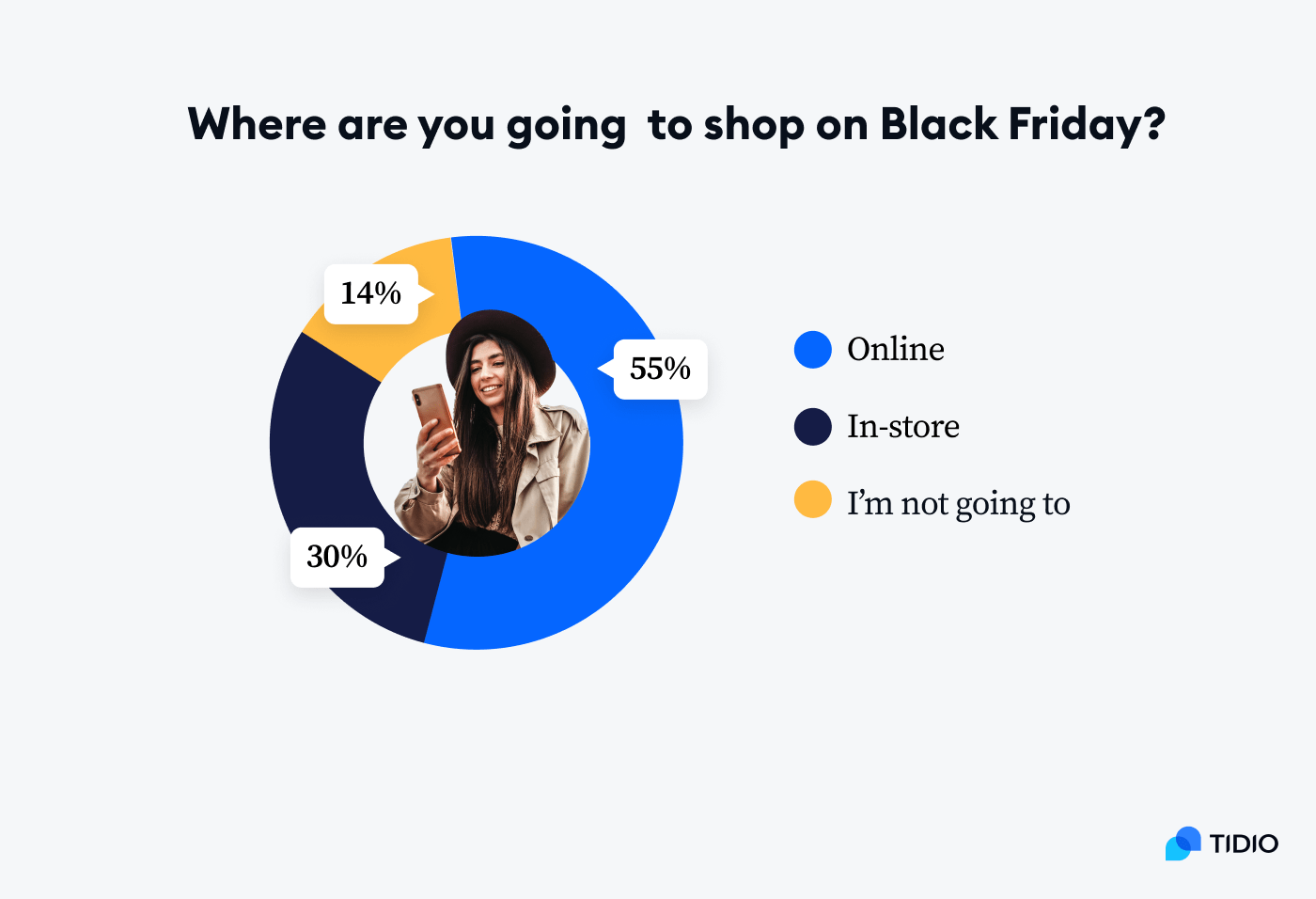

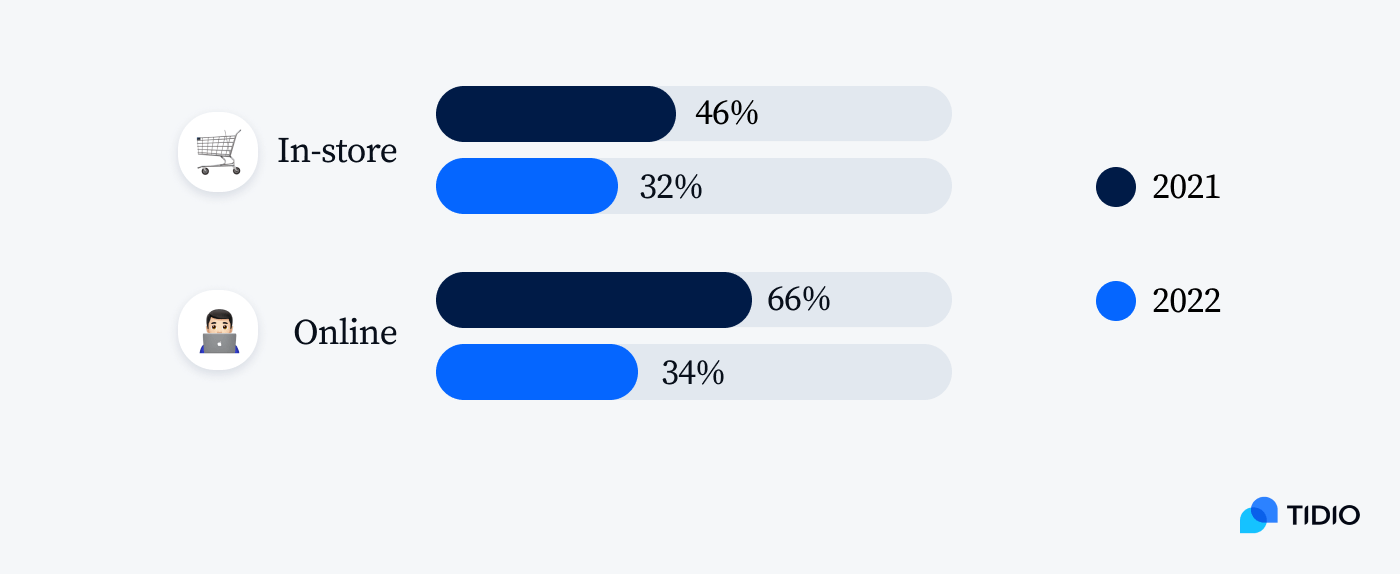

Also, in comparison to our 2021 results, the number of online shoppers decreased from 64% to about 55% during the last year’s holiday shopping season. This means that more shoppers will go to the stores this year than during the previous holiday season.

What about people who refuse to shop on Black Friday?

The number of consumers who declare that they are not taking part in the BFCM extravaganza is about 14%. The reasons for people skipping the event vary: from lack of time, not having enough money to spend, and having to work on that day.

But let’s go back to the people who are going shopping during the Black Friday weekend. What products end up in the shoppers’ baskets?

Over 47% of people shop for things they’ve been wanting to get for a while

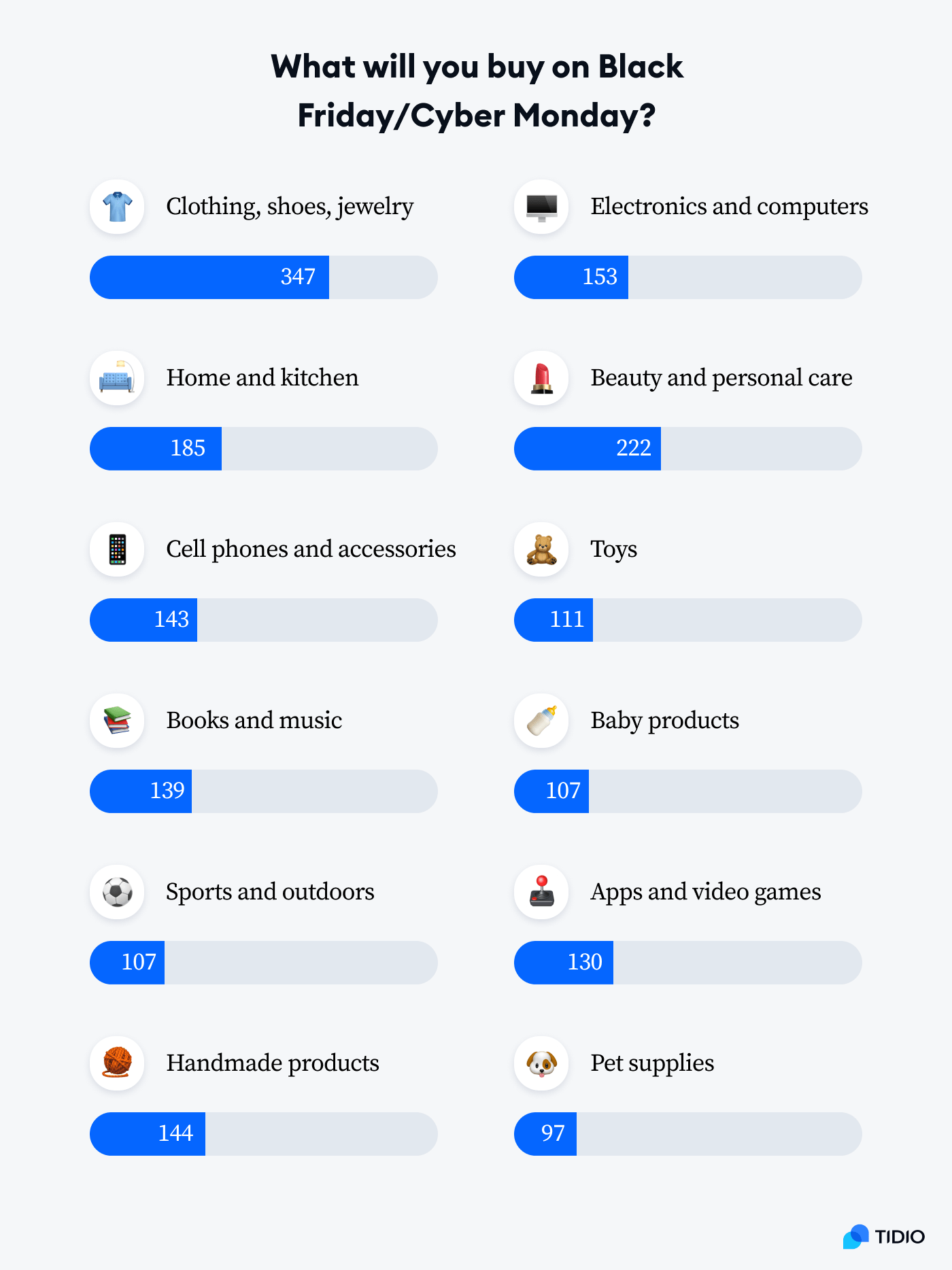

Black Friday data shows that retail sales are still the top product category during this shopping event. Clothing, shoes, jewelry, and beauty products are the trending Black Friday deals. So retailers who sell these items should restock on their bestsellers and prepare for the fast delivery processes.

In comparison with last year, Black Friday shopping stats show that fewer people are interested in buying electronics, such as smartphones, AirPods, and TVs. More of us are after the beauty and personal care items this year. Let’s treat ourselves to a home spa day, why don’t we?

When creating your marketing strategy, keep in mind that price isn’t the biggest consideration anymore when it comes to shopping during BF & CM.

Delivery takes the two podium spots. About 31% of people look for free delivery, 25% search for products with fast delivery, and 24% check customer reviews before purchasing an item.

How much should Black Friday discounts be?

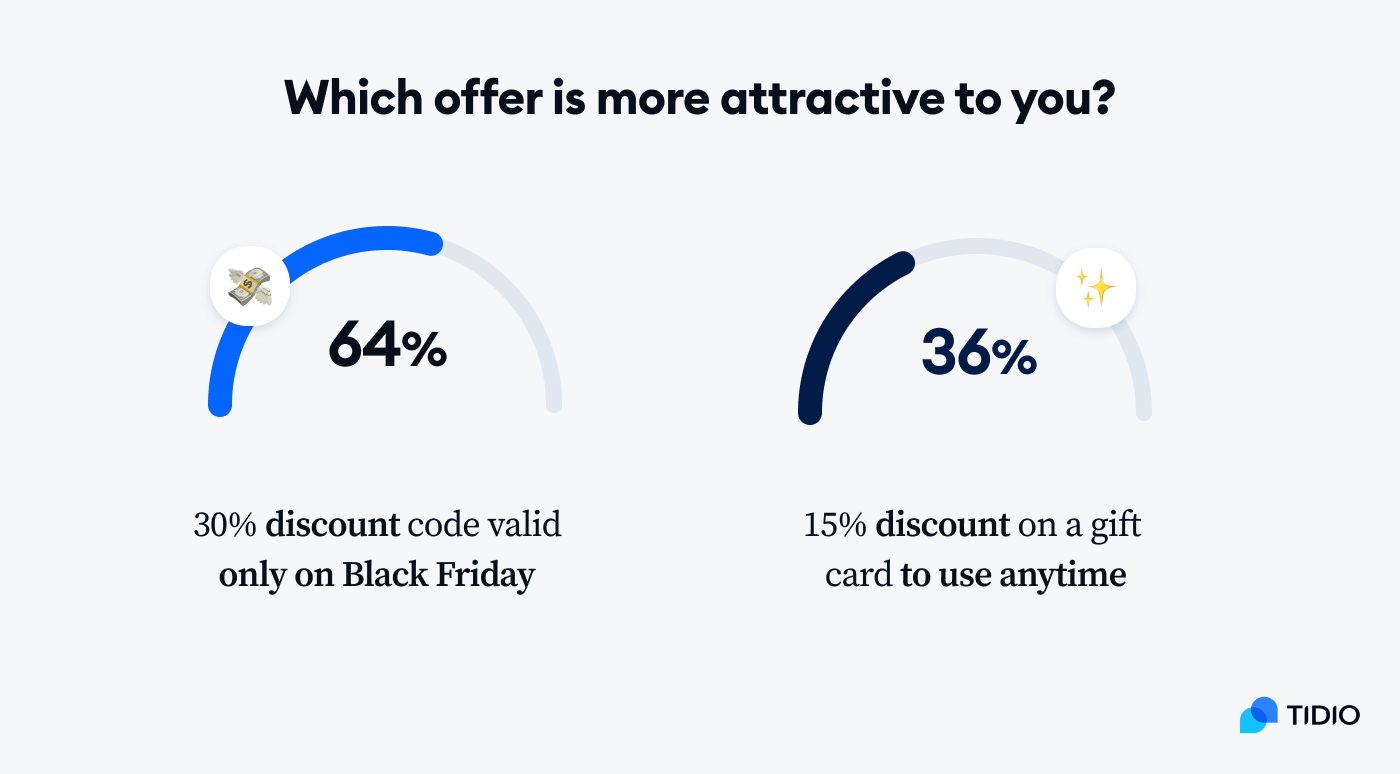

Firstly, it’s worth noting that shoppers prefer to buy items on the day of Black Friday & Cyber Monday events instead of getting a discount to use whenever they like.

In fact, 62% of people prefer a 30% discount code valid only on Black Friday instead of a 15% discount on a gift card to use anytime. Remember that when preparing your Black Friday offers and discount codes.

Nearly all shoppers (88%) compare discounts before buying a product during the Black Friday sales

Half of our responders will even spend a few hours comparing the discounts during the Black Friday and Cyber Monday events to get the best bargains.

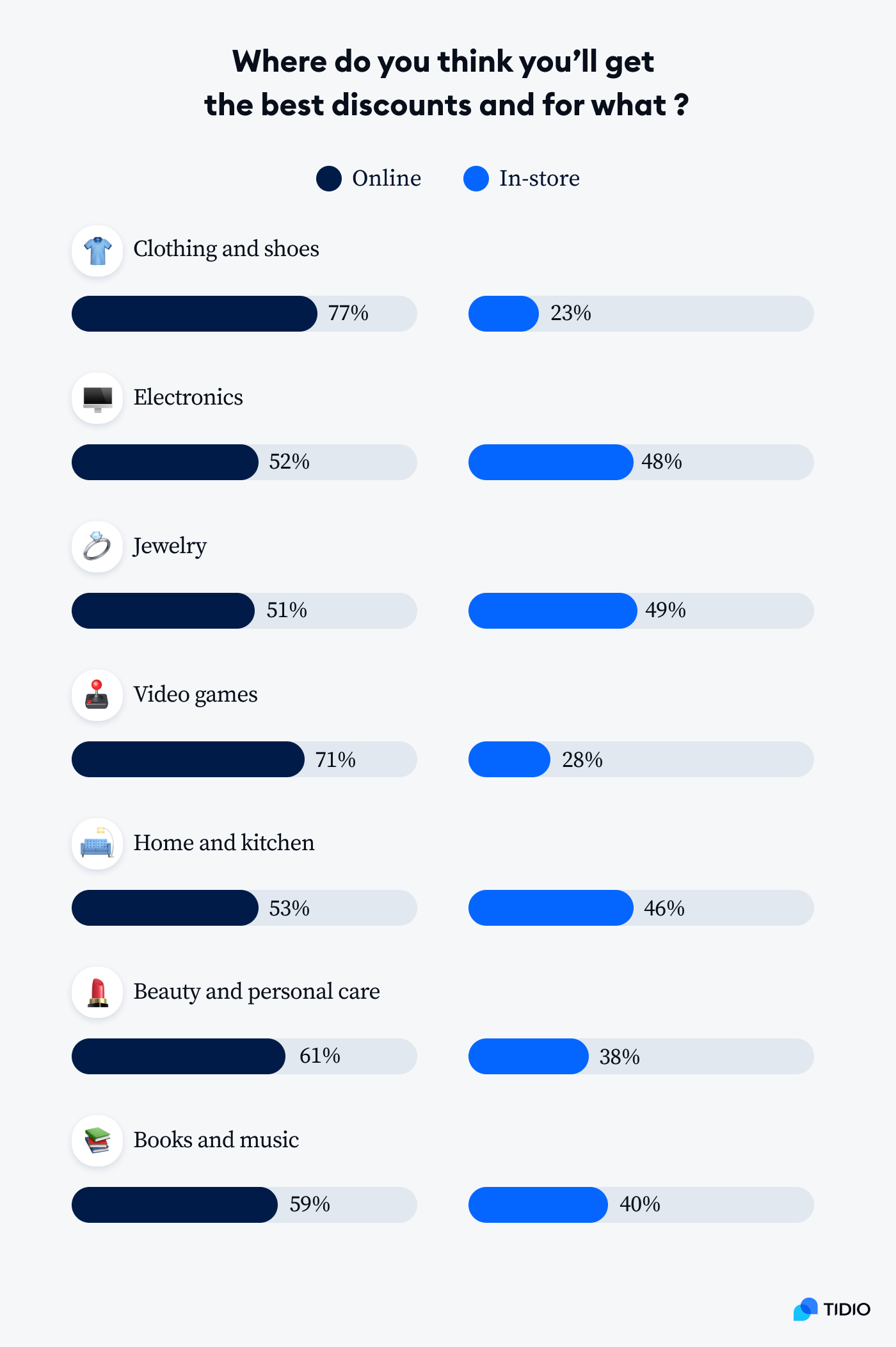

Most customers feel that online Black Friday sales are higher than the ones in stores for almost every type of product. Interestingly, online shoppers are also more likely to give in to marketing techniques, like creating urgency and scarcity.

So, what is the average Black Friday discount?

Holiday discounts in 2022 increased by 20.5% year-over-year (YoY) across the entire sales season with discounts averaging at 21%.

So—

Where is the best place to get the most customers? In the physical stores or online?

More customers will shop online than in stores this year

The online shopping trend continues. Online deals seem to be more popular not only during Cyber Week but also for the Black Friday sales event. Our Black Friday Cyber Monday (BFCM) statistics might not be good news for small businesses and boutiques that don’t have an online presence, as most Black Friday spending happens through the internet during the shopping season. On a positive note though, other Black Friday consumer research points to Small Business Saturday being a more popular holiday shopping day than in-person Black Friday shopping.

On top of that, other studies show a Black Friday trend of buy-online-pick-up-in-store (BOPIS) becoming more and more popular. This method increased 9% globally across the last Cyber weekend compared to the first three weeks of November. And companies offering this fulfillment option grew their revenue by an additional 38% compared to businesses that didn’t provide the BOPIS method.

About 34% of buyers who are planning to shop online are going to spend more money than the previous year. On the other hand, only 32% of those going to the brick-and-mortar stores are planning to leave more of their cash in the store’s register.

Keep in mind that consumers find shopping via an app on their mobile device (42%) more appealing than filtering products on a website (37%). This could mean that people want to use Amazon, AliExpress, and Wish apps instead of going to more niche ecommerce sites that don’t have their own apps.

So, if you have a startup ecommerce business on Shopify, but no app, how can you get more sales during this Cyber Monday week?

Online retailers can use AI to help Black Friday shoppers find the best deals. It’s worth noting that more customers want to get instant recommendations from a chatbot than via an email newsletter.

It’s a win-win situation with buyers finding the right products and online stores increasing their conversion rates.

Learn how to use the power of AI to maximize BF marketing efforts

Also, note that 36% of people who plan to shop online will look for deals on social media and about 25% of them will look for sales on Google.

So, it’s best to put your marketing efforts on platforms, such as Facebook, Instagram, and Twitter. Also, consider using Google Ads for advertising your products.

Customer attitudes towards Black Friday & Cyber Monday

There’s no denying that people storming Target and Walmart on the 24th of November are fans of Black Friday sales, and it’s not their first time hunting for deals. Sales of Apple products, video games, and even sporting goods are hot for everyone from Gen Z to Baby Boomers.

But, what are people’s attitudes toward the event? Are they after the deals or the chaotic experience of the tradition?

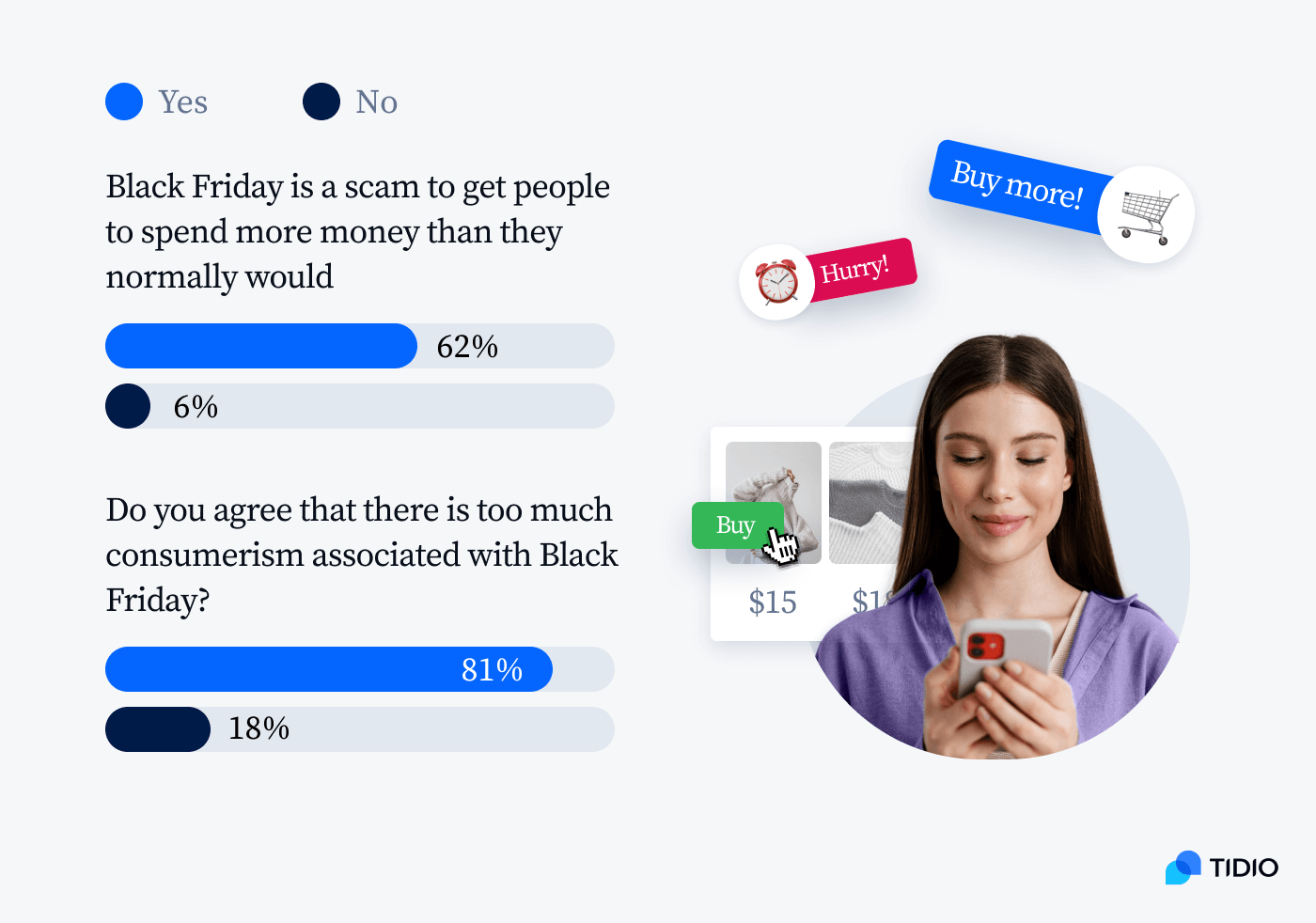

Most consumers think Black Friday is just a scam to get people to spend more money than they normally would

In fact, only 6% of people disagree that Black Friday is a scam. And about 48% of consumers like the sales but not the tradition.

Moreover, research shows that about 60% of shoppers regret buying a sale item they purchased. The average amount spent on these items equals to approximately $233.

In addition to that, over 80% of shoppers say there’s too much consumerism associated with Black Friday and Cyber Monday events.

Also, about 76% of buyers state that companies spam us with too many BF ads. They say that brands start to advertise too early and the ads get annoying fast. On the other hand, 23% of US consumers think that it’s convenient to receive discounts and information about sales in advance.

Being overwhelmed by the ads and the crowds could be one of the reasons people don’t enjoy this event as much. In fact, over 60% of shoppers think there are too many people in the shops during Black Friday.

This brings us to another interesting finding of our Black Friday statistics study—

Most people (77%) would be interested in booking an appointment to shop in order to avoid crowds

Nearly 8 in 10 shoppers would book an appointment online to shop in-store and avoid crowds. One comment from the participants in our study brings up an interesting point—booking an appointment to shop could help disabled people. Maybe you could consider this when preparing your store for the event this year.

Keep in mind that most shops won’t put this booking system in place for this year’s event. Another way to avoid crowds as much as possible is to go shopping outside peak hours. But what are the busiest times during Black Friday shopping?

The peak times for store shopping in the US are between 2 pm and 4 pm. So, if you want to avoid the big foot traffic but still enjoy the in-person shopping experience, then you should visit the mall early this year.

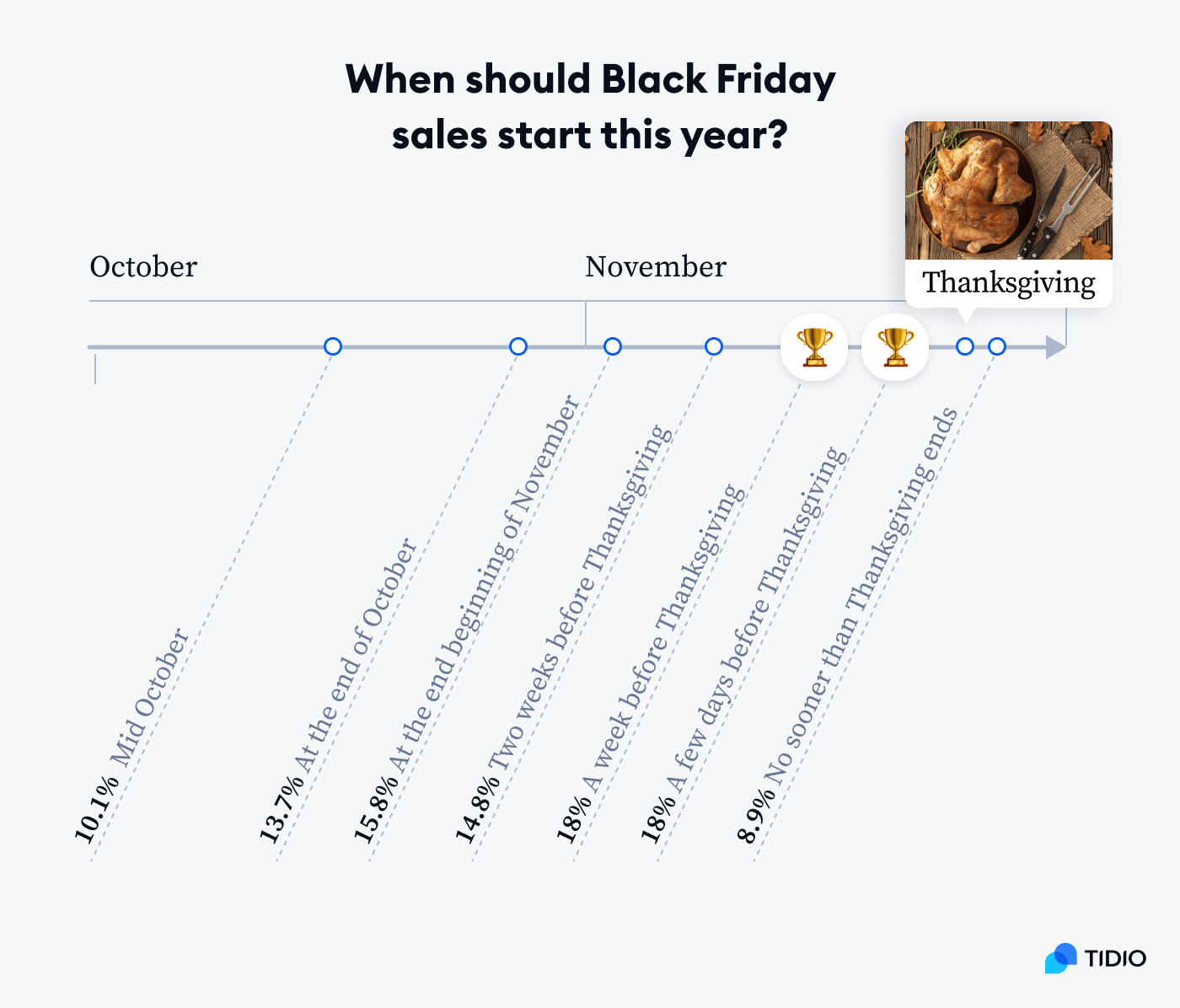

But when do the Black Friday sales start? And when do people think they should start?

Beginning BFCM promotions early is another trend that’s becoming a norm in recent years. Even though Black Friday 2023 is on November 24th, retailers have already kicked off their sales that will run through the Thanksgiving holiday.

However, our survey reveals that the preferred time for the beginning of Black Friday sales is between a week and a few days before the Thanksgiving day.

Prolonged sales periods might suggest customers can get a little tired of an event that’s dragging on for weeks. A week of sales seems like an optimal time to plan their shopping, compare deals, and make sure they are the best available ones.

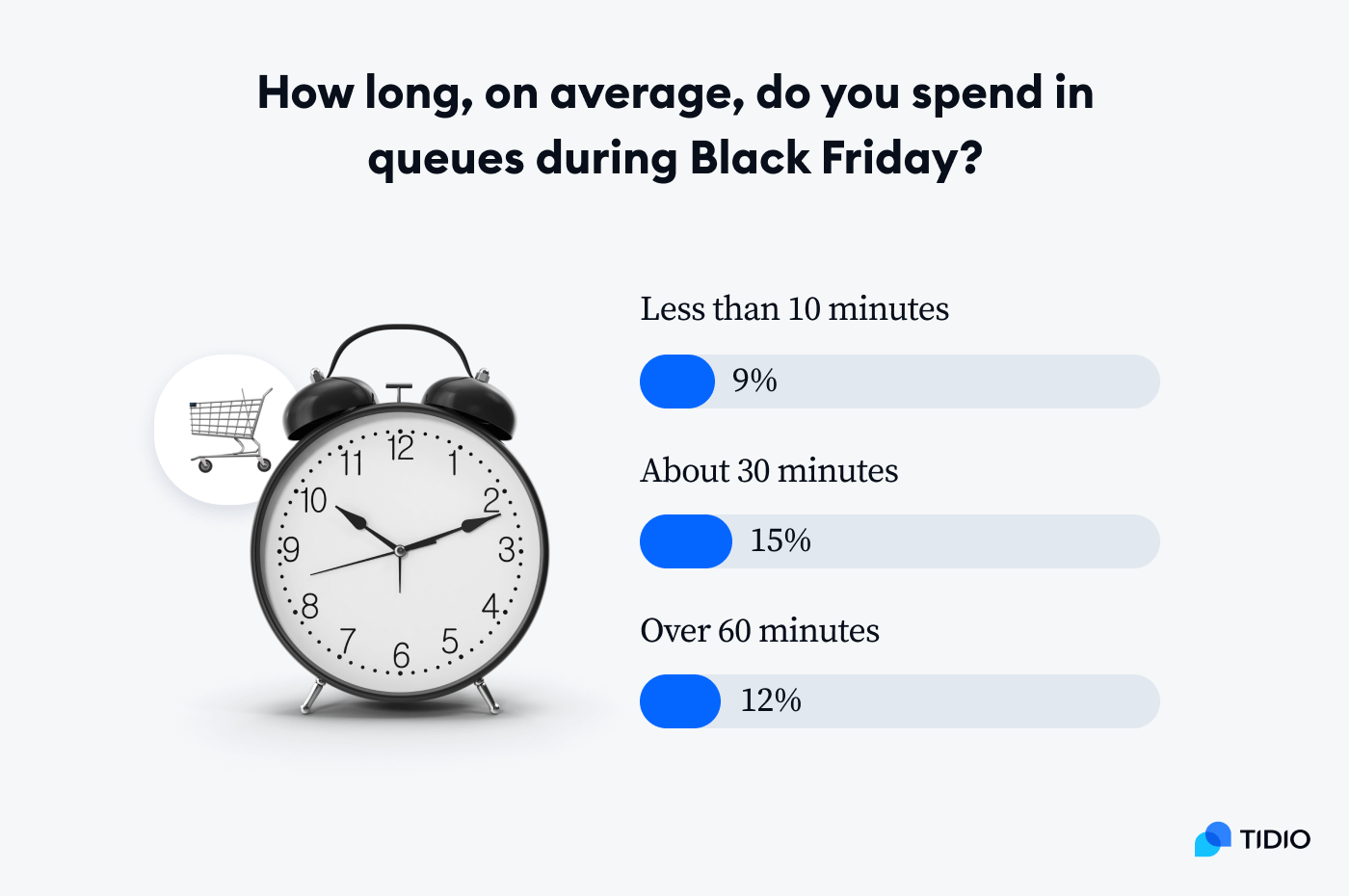

A whopping 82% of buyers are willing to spend over 30 minutes in lines during the Black Friday event

Around 16% of Gen Z wouldn’t spend longer than 10 minutes in a queue. This number falls to only about 6% when it comes to people over the age of 40.

On the opposite side, Millennials are the most patient ground of people when it comes to queuing—over 47% of them would spend over 50 minutes standing in a line during a Black Friday event.

And queues might be even longer this year.

With the current unstable situation, including inflation, supply chain disruptions, and war in Ukraine, 47% of customers predict that people will buy more. This could be to spend money before it loses its value or to stock up on products in case of an emergency.

Our study also found that over 71% of people are angry when they miss the Black Friday sales. In a recent study published in Motivations and Emotions, researchers linked the fear of missing out (FOMO) to the use of social media. Essentially, FOMO in the Black Friday context means that people choose to interact with businesses because they think they will miss out on something valuable.

Cyber Monday and Black Friday trends: key findings

Black Friday continues to be the biggest shopping day of the year in the United States. Many factors, such as inflation, supply chain disruptions, and habits from the pandemic have a considerable influence on buyers’ behaviors and holiday sales.

Black Friday facts and statistics show that most of the customers are moving towards online spending and nearly all shoppers will spend a few hours comparing discounts before purchasing a product. Consumers also feel they can get the best discounts online. And companies can improve their experience by developing a shopping app or a chatbot to recommend the best deals.

While a large portion of customers believe BFCM deals are designed to trick people into buying more, most customers want to take advantage of seasonal sales. They tend to put aside money for this particular occasion and usually buy products they had planned.

Prepare your store for big crowds and ensure fast delivery of your products. Also, make sure you have an online presence and advertise your deals on social media for the best result from this season’s marketing campaigns. This way you can get the most out of the Black Friday and Cyber Monday events.

Sources:

- 148 Million Americans Plan to Shop Super Saturday

- NRF Says 2022 Holiday Sales Grew 5.3% to $936.3 Billion

- US Holiday 2022 Review and Holiday 2023 Preview

- Accenture’s 14th Annual Holiday Shopping Survey

- NRF’s Annual Thanksgiving Weekend Consumer Survey, conducted by Prosper Insights & Analytics

- The Future of Commerce 2021 Report

- Fear of missing out: prevalence, dynamics, and consequences of experiencing FOMO

- The psychology of Black Friday: The thrill of the hunt, the comfort of ritual

- The ultimate guide to Black Friday 2021

- US Holiday 2021 Review and Holiday 2022 Preview

- Thanksgiving Weekend to See More Holiday Shoppers Than Last Year – And Consumers Already Have a Head Start

- Deloitte: Consumer Sentiment Improves as the Excitement of Black Friday Returns

- Holiday Debt Survey

- What Store Traffic Data Reveals About Black Friday Shopping

- Adobe Analytics: Boom! This season’s shopping trends are in.

- Survey: 50% of holiday shoppers will begin before Halloween, 54% report feeling financially burdened

- Black Friday statistics 2022

- Salesforce Reveals Record-Breaking Cyber Week: $281 Billion in Global Online Sales

- Global Online Sales Top $1.14T During 2022 Holiday Season, Salesforce Data Reveals